A History of Dutch Disease: Can Lebanon Get the Better of It?

Alain Joe El Najjar

Hassan Sherry

Introduction:

Recent announcements regarding Lebanon's accession to the Club of Oil Producing States has stirred excitement and hope among its citizens and the international community alike. Whilst the signing of its first exploration and production contracts represents a significant milestone, a cautious scepticism looms over the impact of potential windfall revenues on the desired structural transformation of the country's economy. This is because the experience of many oil-exporting countries shows that there is a significant relationship between the hydrocarbon exports-driven economic prosperity and the decline of the tradable-goods sectors—that is, the agricultural and manufacturing sectors.

In the literature, this trade-off is known as the Dutch-Disease[i]. The mechanism through which the Dutch Disease manifests itself is as follows: there will be an increase in the supply of foreign currency in the oil-exporting country driven by the exports of these natural resources. This will lead to the appreciation of the national currency—it becomes relatively stronger in comparison to other currencies—which makes exports more expensive and imports relatively cheaper, thereby undermining the competitiveness of sectors that produce tradable goods, namely the manufacturing sector. In the same way, oil and gas windfalls often lead to higher wages in the oil and gas sector—the booming sector—so that workers are drawn into this expanding sector while displacing other sectors of the economy.

Yet, as we argue in this article, the Lebanese economy has already been victim of a Dutch Disease-like scenario, driven by massive capital and financial inflows at least since the early 1990s. By exploring the impact of remittances and other capital inflows on the Lebanese economy, this article attempts to draw a lesson for the future management of oil and gas resources in order to avoid remaining victim to the Dutch Disease.

Remittances: Trends and Appraisal

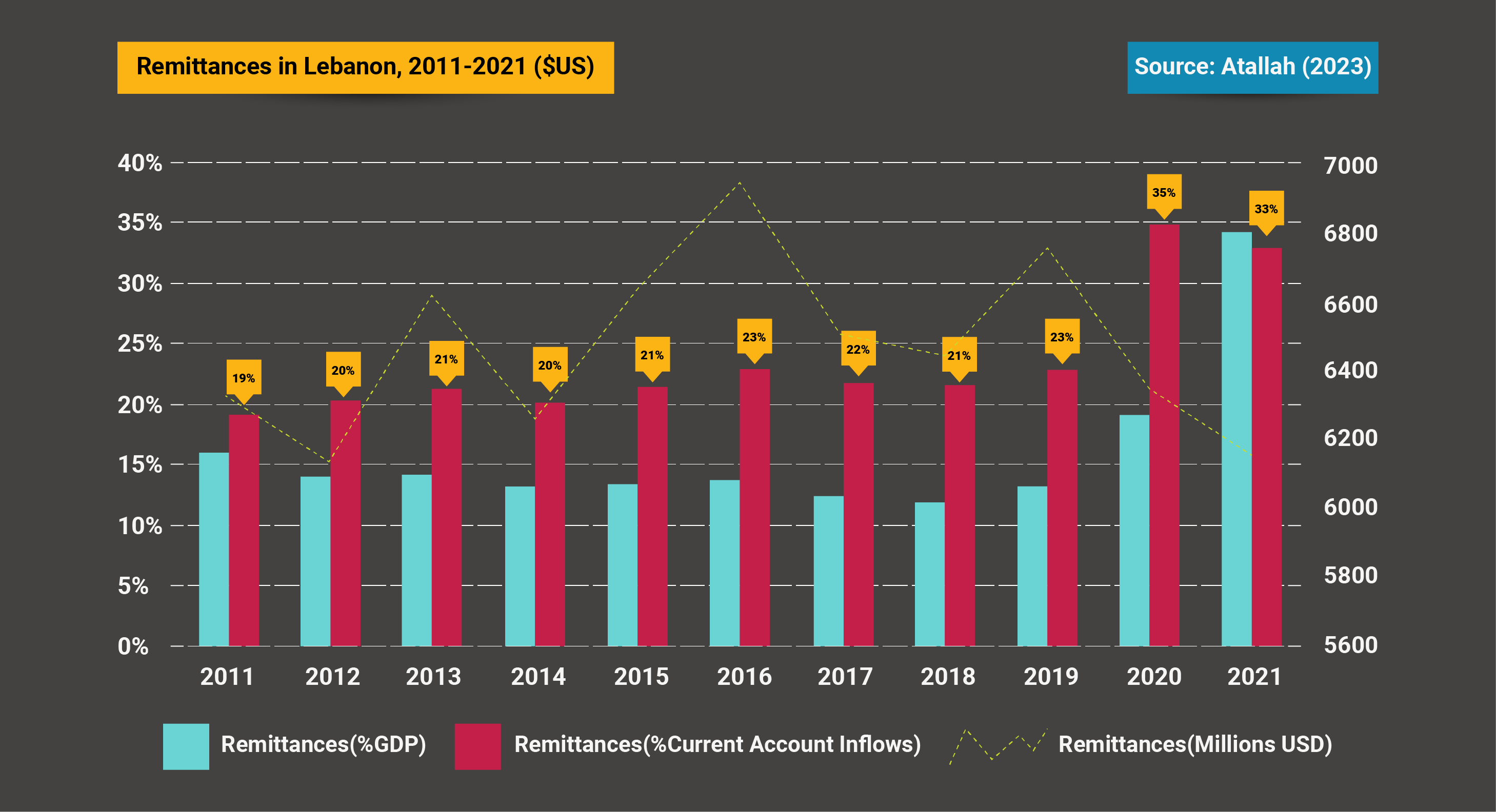

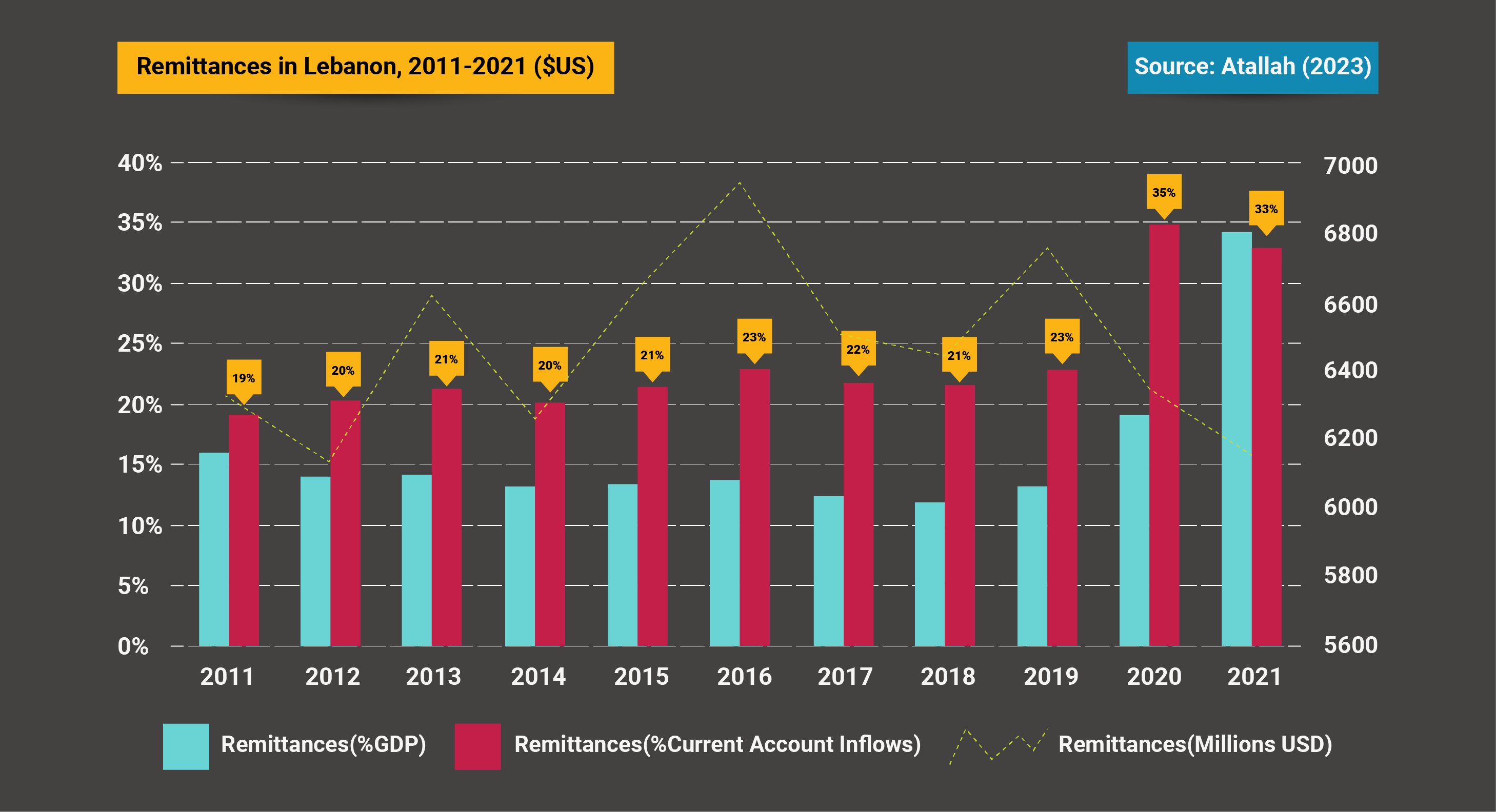

Lebanon witnessed a strong inflow of foreign capital in the form of remittances. According to Atallah (2023), the country has been receiving a constant flow of remittances from 2011 to 2021, hovering between six and seven US$ billion per year.

Figure 1: Remittances in Lebanon, 2011-2021 ($US)

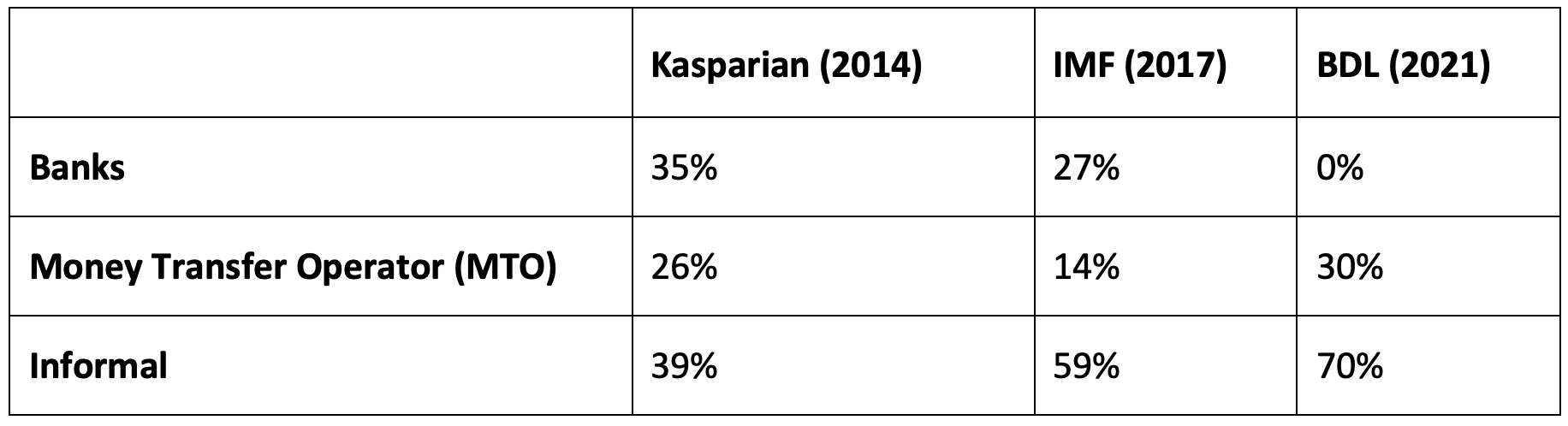

According to the World Bank (2022), the remittances to GDP ratio increased dramatically from 23% in 2019 to 37.8% in 2022[ii], steering the country to rank first in the MENA region and third globally, after Tajikistan (51%) and Tonga (44%). Yet, the onset of the banking crisis in 2019 and the ensuing loss of confidence in the Lebanese financial sector have shifted remittances from formal channels (including banks) to informal channels (mostly cash money) and money transfer operators (such as OMT, BOB or Wester Union).

Table1: Distribution of remittances by channel

Source: Atallah (2023)

As a matter of fact, emittances have generally represented a constant flow of capital to the Lebanese financial system. They have also played a significant role in the battle against poverty, along with improving access to education and healthcare, thus acting as a “social safety net” by absorbing shocks and smoothening crisis effects (Amuedo-Dorantes, 2014; Azizi, 2018; Chami et al., 2018; Oguri, 2020).

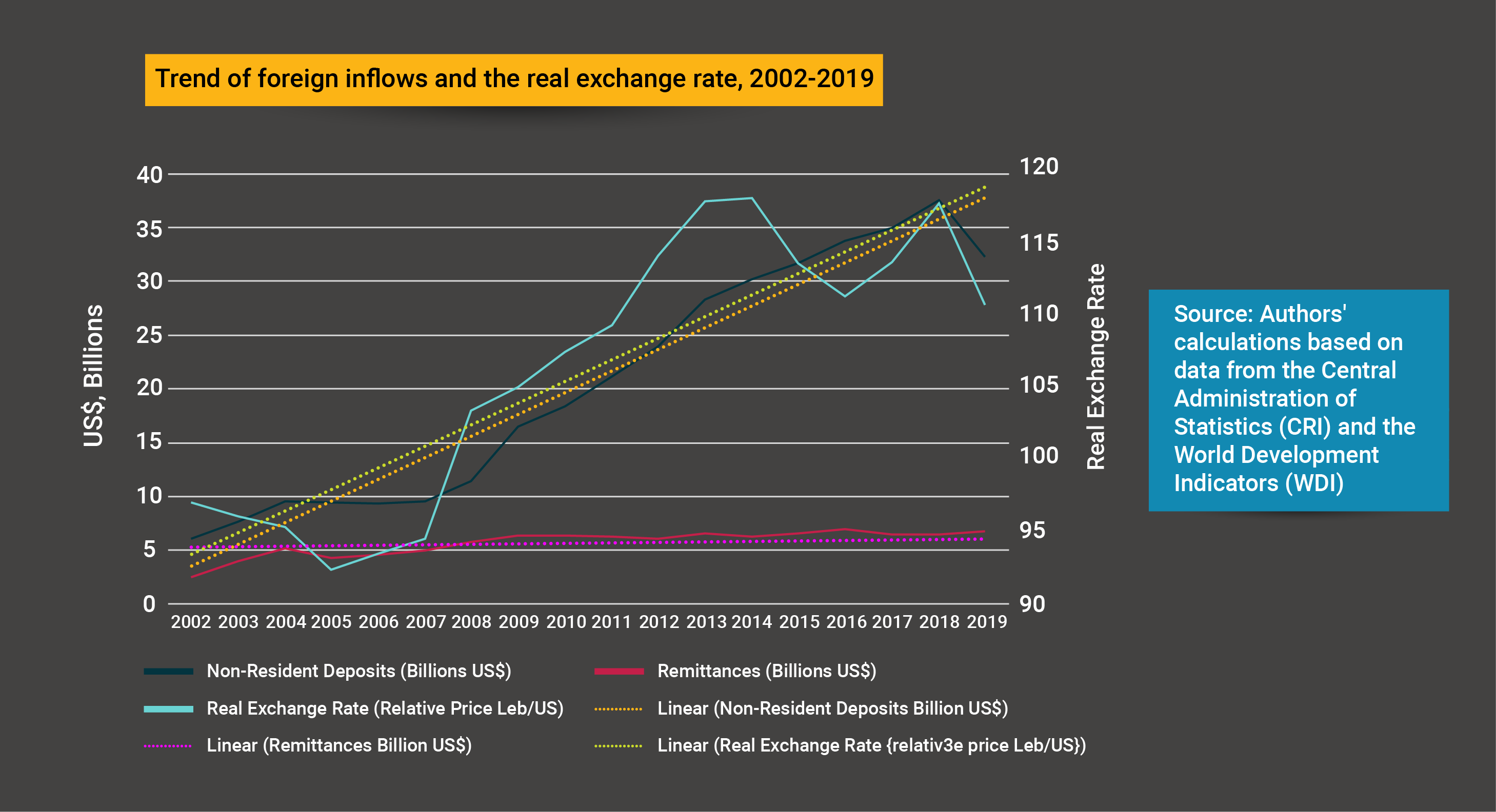

However, the prevalence of remittances comes with its own set of challenges. Remittances have shown to instate a dependency of the household on the sender and can discourage recipients from engaging in productive economic activities. They might also reduce incentives to save, while promoting luxurious consumption habits. But, perhaps the most important implication of remittances—as is the case with various inflows of capital and finance—is that it can often lead to real exchange rate appreciation and a loss of competitiveness of the country’s export sector. Figure 2 below demonstrates the trend in foreign inflows, including remittances and non-resident deposits—another source of inflows, usually denominated in foreign currency, with yet a more profound impact on real exchange rate appreciation and loss of competitiveness.

Figure 2: Trend of foreign inflows and the real exchange rate, 2002-2019

In the context of Lebanon’s political economy and the lack of industrial policy geared towards financing productive investments, the windfall gains in foreign currency as a result of inflows of remittances and non-resident deposits has often led households to invest in the non-tradable sector, notably the real-estate sector instead of agriculture, manufacturing or higher value-added services like Information and Communications Technology (ICT) or financial consulting, which are more likely to boost and sustain economic growth (Hourani, 2005; Awdeh, 2014).

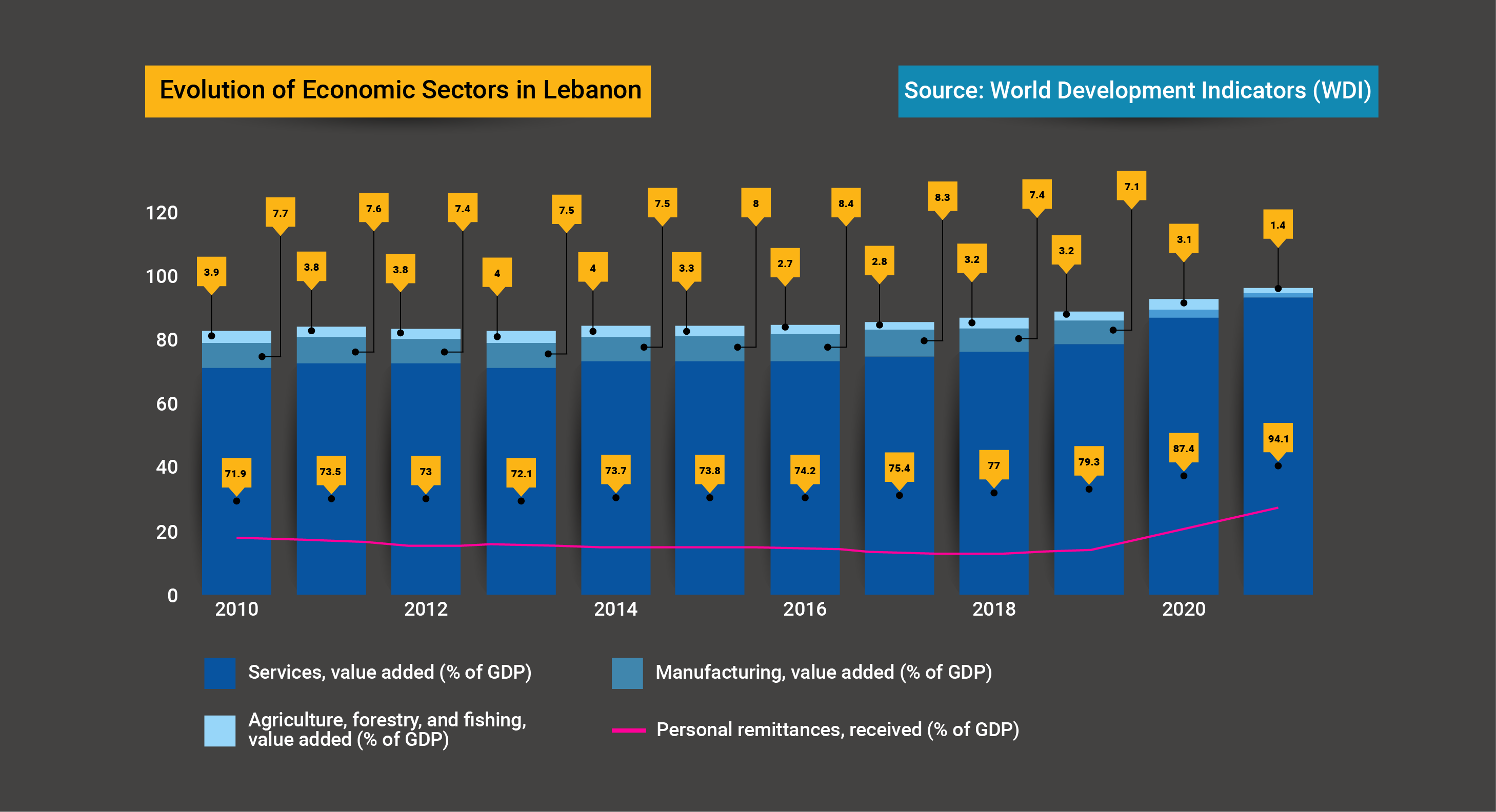

This appreciation of the real exchange rate has been accompanied by shrinking productive sectors in the economy—a phenomenon that is usually referred to as de-industrialization. The reason why industrialization is problematic is because productive sectors, especially manufacturing, have the most significant effect on growth through increasing returns to scale, learning by doing, linkages and spill-over effects, among other positive externalities (Rajan & Subramanian, 2005; Brahmbhatt et al. 2010; Chaaban & Harb, 2019).

Figure 3: Evolution of economic sectors in Lebanon

Concluding Remarks and Implications for Policy

Just as remittances and non-resident deposits have contributed to the Dutch Disease phenomenon in Lebanon, other sources of large inflows of foreign currency, such as revenues from potential oil as gas exports, can also lead to a Dutch Disease-like scenario, whereby the relative price of non-tradable goods (services) will increase, leading to the appreciation of the real exchange rate and the loss of export competitiveness. Such tendencies will be exacerbated short of a public policy approach that adequately manages the potential revenues of the hydrocarbons sector in a way that reduces the state’s dependency on the sector while enhancing the economy’s resilience towards external shocks. A prerequisite to this future outlook is, of course, the presence of political will that would first allow the economy to navigate its current deep-seated economic and financial crisis.

A desirable macroeconomic strategy for economic recovery and development should strive to manage foreign currency inflows or windfall revenues in order to maximize their social and economic benefits. In this respect, a reallocation of resources towards implementing horizontal industrial policies such investing in physical and human capital, infrastructure, research and development (R&D), in addition to reforming the existing institutional and legislative framework. This would furnish a conducive environment for investment, while aligning business with the Sustainable Development Goals (SDG). Perhaps this can serve as a recipe that not only supports Lebanon in reducing its overt dependence on foreign inflows, but also in initiating recovery and embarking on a path of positive structural change, which can promote diversification in the country’s production (and export) structure, create decent jobs, and alleviate the decades-long phenomenon of brain drain.

Appendix: The Core Dutch Disease Hypothesis (Corden and Neary, 1982).

The main idea behind the Dutch Disease Hypothesis à la Corden and Neary (1982) is that the large inflows of foreign currency cause the real exchange rate to appreciate, thereby decreasing export competitiveness. This could be explained by two effects: i) the resource movement effect, where labour moves from the tradable goods sector (for example, manufacturing) to the booming sector (for example, oil), and causes de-industrialisation; and ii) the spending effect, whereby windfall revenues cause spending to increase, thus driving up domestic prices, namely the prices of non-tradable goods (since the price of tradable goods is determined by global supply and demand). As a result, the relative price of non-tradable goods will rise relative to tradable goods, causing real exchange rate appreciation, which renders exports less competitive in international markets and encourages imports.

Alain Joe El Najjar

Hassan Sherry

Bibliography

Amuedo-Dorantes, C. (2014). The good and the bad in remittance flows. IZA World of Labor. https://doi.org/10.15185/izawol.97

Atallah, S. (2023). The increasing role and importance of remittances in Lebanon. UNDP. Available at: https://www.undp.org/sites/g/files/zskgke326/files/2023-06/remittances_report_june_2023.pdf

Awdeh, A. (2014). Remittances to Lebanon: Economic impact and the role of. banks. In National Workshop on: Remittances and Economic Development in Lebanon, Beirut.

Azizi, S. (2018). The impacts of workers’ remittances on human capital and Labor Supply in developing countries. Economic Modelling, 75, 377–396. Available at: https://doi.org/10.1016/j.econmod.2018.07.011

Chaaban, J., & Harb, J. (2019). Macroeconomic implications of windfall oil and gas revenues in Lebanon. The Future of Petroleum in Lebanon. Available at: https://doi.org/10.5040/9781788318518.ch-009

Chami, R., Ernst, E., Fullenkamp, C., & Oeking, A. (2018). Is there a remittance trap? – IMF finance & development magazine: September 2018. Is There a Remittance Trap? - IMF. Available at: https://www.imf.org/en/Publications/fandd/issues/2018/09/is-there-a-remittance-trap-chami

Corden, W.M. and Neary, J.P., 1982. Booming sector and de-industrialisation in a small open economy. The economic journal, 92(368), pp.825-848.

Oguri, J. (2020). Part II of crisis in Lebanon: Buildup of interrelated challenges. Part II of Crisis in Lebanon: Buildup of Interrelated Challenges. Available at: https://som.yale.edu/blog/part-ii-of-crisis-in-lebanon-buildup-of-interrelated-challenges

World Bank Group. (2022). Lebanon’s crisis: Great denial in the deliberate depression. World Bank. Available at: https://www.worldbank.org/en/news/press-release/2022/01/24/lebanon-s-crisis-great-denial-in-the-deliberate-depression

[i] An overview of the channels through which the Dutch Disease materialises can be found in the appendix.

[ii] The increase in the share of remittances to GDP is partly explaining by the country’s contraction of real GDP since the onset of the economic and financial crisis in 2019.

Recent publications