Economic free fall, absence of social protection and the international community’s assistance in Lebanon - Olga Jbeili

Economic free fall, absence of social protection and the international community’s assistance in Lebanon - Olga Jbeili

Lebanon’s multi-dimensional crisis and the State’s inability to provide social protection

Lebanon is undergoing an unprecedented multi-dimensional crisis that is exacerbating social vulnerabilities and deepening inequalities. Additionally, Lebanon was hardly hit by the Covid-19 pandemic and the devastating Beirut Port explosion on the 4th of August 2020, which accelerated the deterioration of already weak public services and wreaked havoc infrastructure such as access to health, education and energy. These structural inefficiencies are further aggravated by the status-quo, political deadlocks and the absence of decision making and political will to implement much needed reforms.

The severity of the crisis is described as “one of the top ten, possibly top three most severe economic collapses worldwide since the 1850s; it has come to threaten the country’s long term stability and social peace. The country’s post-war economic development model which thrived on large capital inflows and international support in return of promises of reforms is bankrupt. In addition, the collapse is occurring in a highly unstable geopolitical environment making the urgency of addressing the dire crisis even more pressing”.

As the World Bank puts it “the scale and scope of Lebanon’s deliberate depression are leading to the disintegration of key pillars of Lebanon’s post-civil war political economy. This is being manifested by a collapse pf the most basic public services; persistent and debilitating internal political discord; and a mass brain drain.”

Given this context, real GDP is estimated to have declined by 10.5% in 2021, compared to 21.4% contraction in 2020 as policymakers have still not agreed on a plan to address the collapse of the country’s development model according to the World Bank (2022). The share of the Lebanese population under the national poverty line is estimated to have risen by 9.1 percentage points by end of 2021 and Lebanon has witnessed a catastrophic collapse in basic public services driven by the depletion of foreign assets reserves.

Today Lebanon is enduring an unprecedented hyperinflation, according to the Central Administration of Statistics (CAS), the Consumer Price Index (CPI) revealed that Lebanon’s monthly inflation rate jumped from 110.24% in April 2021 to a record high of 222.88% in April 2022. Hyperinflation is mainly linked to the depreciation of the national currency from 1,500 LBP/USD in October 2019, to 39,400 LBP/USD in October 2022.

Figure 1: Inflation rate in Lebanon (2018 – 2022)

Source: Author's adaptation from BlomInvest (2022)

As a result of the devaluation, the minimum wage that was previously set at 675,000 LBP (450 USD) declined by over 84% until April 2021 averaging no more than 72 USD. Although in May 2022 average wages in the private sector were increased by 50% from 1,325,000 LBP to a total of 2,000,000 LBP - employees lost 92% of the value of their income in today’s dollar terms as this increase is equal to 75 USD compared to 883 USD before 2019. It is worth noting that the ratio of families below the minimum wage was 18% in 2019, today this ratio has increased to over 84% (Nehme, 2021) while the standards of living and the purchasing power further deteriorate. In parallel, the unemployment rate increased from 11% in 2019 to 30% in 2021 according to the Central Administration of Statistics (CAS).

More recently, according to the World Food Programme (WFP), the war in Ukraine is impacting Lebanon’s fuel and food prices as the country is import-dependent on both commodities getting 80% of its wheat from Ukraine, which together with Russia supplies 30% of the grain worldwide. In that regard, food prices dramatically rose by 628% in two years.

On top of that, the Central Bank was unable to provide liquidity in foreign currency for imports and most of the foreign exchange (FX) subsidies have been removed namely on fuel, food and medicine.

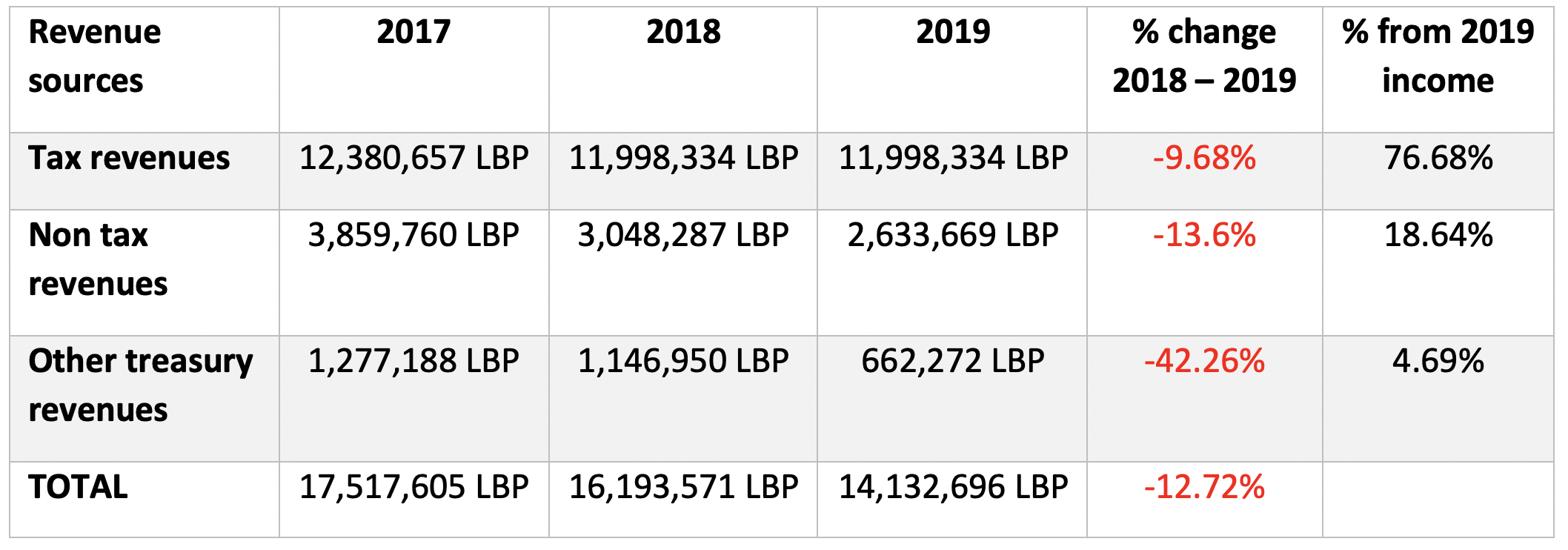

Therefore, the collapse of state institutions, the decrease of government revenues by 12.72% between 2018 and 2019, including a sharp decline by 42.26% in other non-treasury revenues, and delays in adopting a budget since 2020 impacted the state’s ability to finance the pressing and growing social security needs of the population and mobilizing domestic resources for social security and income protection were severely affected.

Table 1: Lebanese government revenue sources (2017 – 2019)

Source: Gherbal Initiative (2022)

By 2017, the debt level reached 143% of GDP and the balance of payments recorded a deficit of 155.7 million USD, which was primarily due to a reduction in foreign currency reserves as the net flow of foreign currencies hit a deficit during the same period. As budget deficits deepened, succeeding Lebanese governments resorted to adding more debt, either in Lebanese pounds by issuing T-Bills, or by issuing dollar denominated bonds and/or Eurobonds on international markets. By March 2020, and for the first time in its history, Lebanon defaulted on its Eurobonds, which amounted to 1.2 billion USD (1.03 billion Euros).

In April 2022, the International Monetary Fund (IMF) and Lebanon reached a Staff-Level Agreement to provide a 3 billion USD loan to cover part of the financing needs estimated at 80 billion USD. This deal is conditional upon Lebanon’s capacity to enact reforms.

Within this context, the Lebanese cabinet passed in May 2022 a financial recovery plan needed to secure international aid. However, this plan remains debatable and its implementation will depend on the formation of a new government.

Filling the gap

The ability of Lebanon to cope with overlapping shocks is weak in light of the incapacity of state institutions to mobilize domestic resources to provide the required financial and logistical needs supporting social protection and basic services. Therefore, Lebanon significantly relies on the international community through its affiliated agencies and multilateral organization to fill the void and to support two main sectors: food security and health care. The international support comes in three forms: (1) Pooled Funds; (2) Response Plans / Appeals; (3) Bilateral Grants and Loans.

While the flows of the private donations have been largely untracked, many of the assistance provided to governments and international organizations are reported via the United Nations Office for the Coordination of Humanitarian Affairs (UNOCHA) and the Lebanese government.

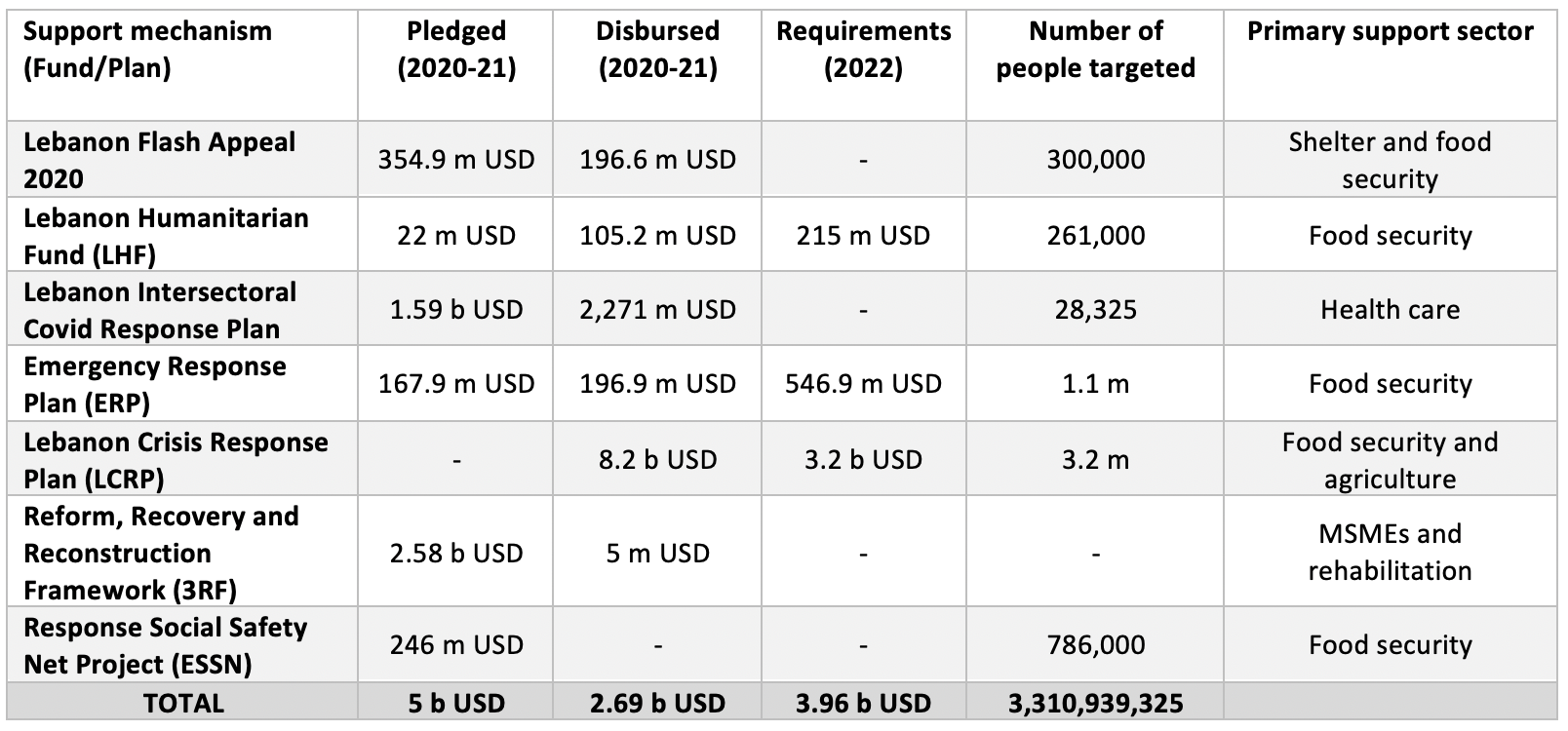

The table below summarizes the total amounts pledged and disbursed by the international community in comparison to the actual requirements. The table also highlights the number of people targeted and the primary sector supported.

Table 2: Summary of pledged, disbursed and required support through existing mechanisms

Source: Author’s compilation and calculations.

To this day, based on available data sourced from UNOCHA, the international community disbursed between 2020 and 2021 2.7 billion USD approximately to support Lebanon, far short of what it initially pledged 5 b USD.

Amid this context, the financial requirements for 2022 are estimated to be around 4 b USD, while the amounts pledged from the years 2020 and 2021 amounted to 1.6 b USD.

It is worth noting that total incoming funding to Lebanon has been decreasing by over 50% after 2020, reaching 1.08 b USD in 2021 and 518.7 m USD in 2021 amid a worsening global and local crisis.

Of the total incoming funding the biggest share will be allocated to governmental institutions (1.12 b USD) followed by NGOs (13 m USD) and lastly UN agencies (12 m USD).

Concluding Remarks

The limited capacities of the State to provide social protection should not mean that the solution to the crisis is the reliance on the international community at the expense of State-building to ensure a sustainable recovery on the long run. Relying on international aids, grants and loans is associated with conditions that are hardly applicable in the short run as needs rise. This approach will further exacerbate unsustainable debt levels while further increasing the dependence on the international community and NGOs while limiting the possibility to build strong state institutions.

Instead, the crisis should provide an opportunity for the State to engage in much needed reforms and find long term sustainable solutions at the institutional, social and economic levels. To build back better, the State should strike a balance between short term pressing humanitarian needs while strengthening governance and the rule of law.

More importantly, the crisis should be an opportunity to collectively think of building the underlying systems for a robust national social safety net in Lebanon, which is not existent today yet highly needed as the multi-dimensional crisis showed.

The National Poverty Targeting Program (NPTP) launched in 2011 by the Government of Lebanon with technical and financial assistance from the World Bank is the only poverty-targeting social safety net program for the poorest and most vulnerable families targeting extreme poor Lebanese households defined as those unable to meet their basic food needs.

In 2021 the World Bank Group’s Board of Executive Directors approved a 246 million USD loan after Lebanon defaulted on its Eurobonds. The new project entitled the Emergency Crisis and Covid 19 Response Social Safety Net Project (ESSN) aims to provide emergency cash transfers and access to social services to approximately 786,000 poor and vulnerable Lebanese (147,000 households) suffering of the consequences of the economic crisis and the pandemic. Eligible households will receive a monthly transfer of LBP 100,000 per household member, in addition to a flat amount of LBP 200,000 per household.

The ESSN will scale-up and enhance the NPTP while adopting Proxy Means Testing (PMT) targeting methodology to identify eligible beneficiary households as well as categorical targeting to prioritize socially vulnerable groups.

The World Food Programme (WFP) supports the food assistance component of the NPTP which is delivered via e-cards which can be used in more than 400 WFP-contracted shops to buy food. The programme’s main role is to keep Lebanese families away from hunger in light of the lifting of subsidies on basic commodities as the economic situation worsens without apparent solutions in sight.

In 2022, the Lebanese government announced the initiation of cash transfers to 150,000 extreme poor Lebanese households. The program will provide approximately 680,000 individuals with a monthly transfer of 20 USD per household member (maximum 6 members per household), in addition to a flat amount of 20 USD per household. It will also cover the direct costs of schooling for 87,000 children between the ages of 13-18 years to prevent school drop-out among extremely vulnerable households.

Finally, some progress is already being initiated to develop an Integrated National Social Registry that will enable Lebanon to address future shocks rapidly, transparently, and equitably. Such a National Social Registry should create synergies across all social protection programs and reduce duplication, and should also help standardize implementation processes, decrease the cost-of-service delivery and increase program performance.

The crisis is an opportunity to collectively and inclusively think about the values of nation building and the building blocks of state institutions.

Recent publications